Four Ways to Leverage Social Media to Super Charge Your Investor Relations Strategy.

Peanut butter and jelly.

Eggs and bacon.

Peas and carrots.

Salt and pepper.

Investor relations and social media.

Yes, you read that correctly. Some things just go together. Investor relations in 2022 and beyond requires integration of a smart and strategic social media plan—no matter your investor base—institutional, retail, or both.

Great– so where do you start? It’s important to first understand who you’re interacting with on social, so you build the right kind of content, figure out how you’ll interact with the inevitable troll, and of course your important stakeholders. And finally, develop your plan for social listening to understand how your messages are being received by your key audiences.

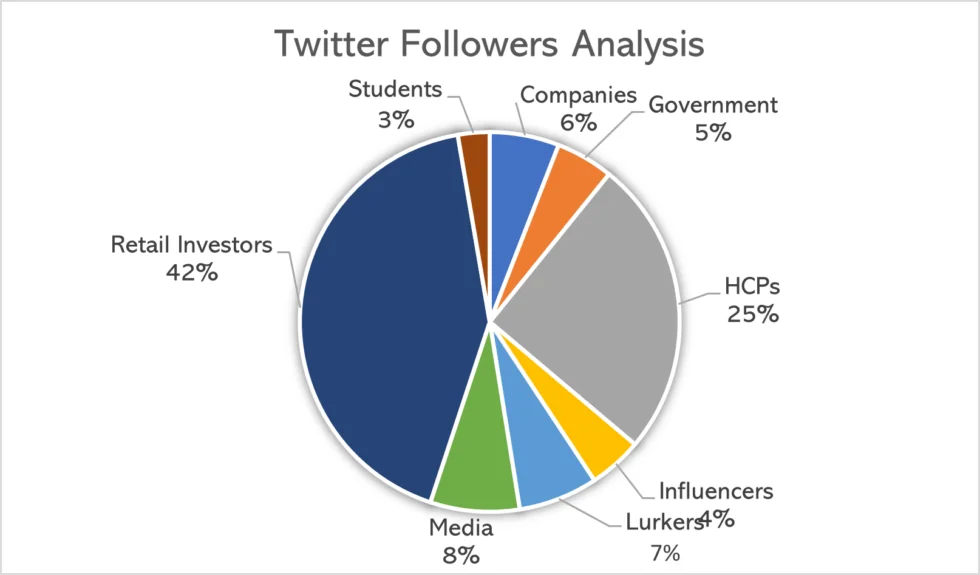

First, understand your audience. You may have an editorial calendar, but if you don’t know your audience, you may be off target in your content type, cadence, and tone. If you’re involved in very high science endeavors, adjusting your message may be necessary to help your investors understand your work. Our team offers turnkey social media audience analysis which can help to easily identify your audience—who they are, who your influencers are, where they live, and what their interests and careers are. Having this information can help define the type and quantity of content you should be creating.

Second, determine how and when you will engage with your investors on social media. Several really interesting tools exist to engage your audience, including Say, which was recently acquired by Robinhood, but even before engaging in a tool like Say, consider a triage approach for social media. Understanding the kind of post or user you are engaging with can help you to determine how to move forward. Trolls and influencers require a very different types of engagement—and you need a plan to define that interaction. Our team has worked with many of our clients to develop social media triage strategies which help to improve and enhance your investor relations program.

Third, listen. No, really, listen. Read, understand, and listen. Sometimes it can be distracting, maddening, and downright hard to dig into the comments on sites like Yahoo! Finance, Reddit, or Twitter. Take 15 minutes each day to do a quick scan of comments, determine which messages are resonating, which ones need tweaking, or which ones are missed all together. And then get out. Leverage that knowledge to continue to hone your messaging. While not directly responding to the comments or tweets, improve or refine your messaging based on that insight. We offer our clients a weekly social media listening analysis to gauge things like sentiment, keywords, notable moments, opportunities, and influencer activity. These quick reports help IR professionals keep a pulse on their audiences without getting bogged down in the comments.

Finally, social media offers an unparalleled opportunity to showcase your ESG chops. In a recent blog, my colleague, Paul Sagan discussed the importance of ESG in an investor strategy. One of our partners, Arena Pharmaceuticals, has done a great job telling their ESG story by leveraging social media and developing ESG-focused collateral.

Share This Post